ETH Price Prediction: Will It Surge to $4,000 Amid Bullish Signals?

#ETH

- Technical Strength: MACD crossover and Bollinger Band squeeze suggest upward potential.

- ETF Speculation: Approval rumors could accelerate buying pressure.

- Regulatory Risks: Tornado Cash verdict may temporarily dampen sentiment.

ETH Price Prediction

ETH Technical Analysis: Key Indicators to Watch

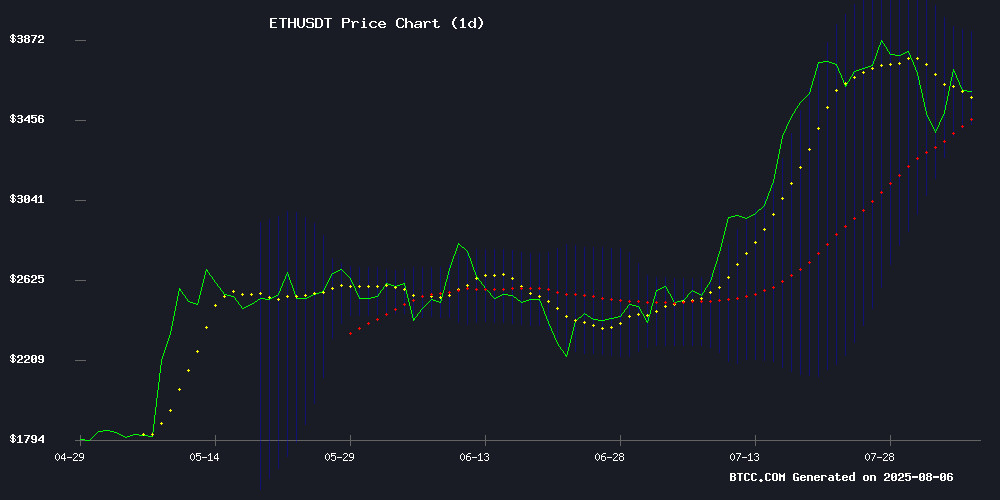

According to BTCC financial analyst Emma, ETH is currently trading at $3,676.67, slightly below its 20-day moving average (MA) of $3,678.37. The MACD indicator shows a bullish crossover with the histogram at 176.0622, suggesting potential upward momentum. Bollinger Bands indicate a neutral to slightly bullish trend, with the price hovering NEAR the middle band. A breakout above the upper band at $3,919.77 could signal a strong bullish move.

Ethereum Market Sentiment: ETF Hype and Network Upgrades Fuel Optimism

BTCC financial analyst Emma notes that ethereum is gaining traction due to ETF speculation and upcoming network upgrades like EIP-7849. Positive headlines around ETF inflows and Vitalik Buterin's fee structure proposal are boosting market confidence. However, legal uncertainties, such as the Tornado Cash case, may introduce short-term volatility. Overall, sentiment leans bullish, aligning with technical indicators.

Factors Influencing ETH’s Price

Ethereum Gains Momentum Amid ETF Speculation and Network Upgrades

Ethereum (ETH) has entered a bullish phase in early 2025, fueled by rumors of a potential ETF approval and the completion of its Ethereum 2.0 network upgrade. The cryptocurrency recently breached the $3,200 mark, leaving traders divided on its next move. Meanwhile, passive income strategies like cloud mining are gaining traction among investors seeking exposure without direct trading.

AIXA Miner, a hands-off cloud mining platform, promises daily ETH rewards without the complexities of wallet setups or exchange risks. The service capitalizes on Ethereum's upward trajectory while sidestepping market volatility.

Market sentiment received a significant boost when several firms filed updated applications for Ethereum ETFs with the SEC. The Ethereum blockchain further strengthened its position with a successful sharding implementation—a scalability solution designed to enhance transaction speeds for developers and users alike.

Tornado Cash Co-founder Convicted Amid Rising Crypto Legal Tensions

A Manhattan jury has found Roman Storm, co-founder of cryptocurrency privacy tool Tornado Cash, guilty of operating an unlicensed money transmitting business. The verdict, delivered in the U.S. District Court for the Southern District of New York, underscores the escalating clash between crypto innovation and regulatory oversight.

Prosecutors alleged Storm facilitated the laundering of over $1 billion, including funds tied to North Korea's Lazarus Group. While the jury deadlocked on more severe charges of money laundering and sanctions violations, the case has become a lightning rod for debates about open-source development and financial privacy in decentralized ecosystems.

The defense maintained Storm never intended the protocol for illicit use, with technical complexities reportedly challenging jurors. As legal boundaries for blockchain developers remain contested, this precedent may influence how privacy-focused projects like Ethereum's upcoming upgrades navigate compliance.

Ethereum Nears Critical Breakout Amid ETF Inflows and Market Dominance

Ethereum teeters on the edge of a decisive price movement as institutional demand collides with aggressive profit-taking. The cryptocurrency traded at $3,634.39 after a 2% daily gain, buoyed by its first substantial ETF inflow since February—a $73 million vote of confidence from institutional players.

Regulatory clouds have partially lifted following SEC's staking clarification, allowing ETF providers to enhance their product offerings. Yet the rally faces headwinds: CryptoQuant's Maartunn reveals a staggering $418.8 million net taker volume decline, equivalent to 115,400 ETH sold at market prices—a bearish signal suggesting holders are exiting positions regardless of price impact.

Market dominance tells a brighter story. Ethereum has reclaimed 11.95% of total crypto market share after bouncing from 7.4% support, with analyst Ito Shimotsuma eyeing the crucial 12.5% resistance level. The tug-of-war between institutional accumulation and speculative sell pressure sets the stage for Ethereum's next major directional move.

Tornado Cash Developer Faces Mixed Verdict in Landmark Crypto Privacy Case

Roman Storm, developer of privacy tool Tornado Cash, received a partial victory in Manhattan federal court. The jury convicted him of operating an unlicensed money transmission business but deadlocked on more serious charges of money laundering and sanctions violations.

Prosecutors alleged Storm's Ethereum-based mixer facilitated over $1 billion in illicit transactions, including funds tied to North Korea. His defense maintained the platform was neutral technology that bad actors exploited without his consent.

The verdict leaves unresolved the fundamental tension between financial privacy and regulatory oversight in decentralized finance. Privacy coins like Zcash and Monero weren't implicated, but the case sets precedent for developer liability.

Ethereum Foundation Appoints New Co-Lead to Drive Layer-1 Scaling Efforts

The Ethereum Foundation has restructured its R&D teams, naming Marius van der Wijden as co-lead of the Scale L1 initiative alongside Ansgar Dietrichs and Tim Beiko. The move signals a renewed push to increase Ethereum's gas limit to 100 million while maintaining network security and decentralization.

Van der Wijden brings deep technical expertise from his work on Geth engineering and protocol security. His appointment comes as Ethereum demonstrates tangible progress, having recently raised the gas limit to 45 million during the Berlinterop event.

The Foundation has organized its research around three core objectives: scaling base-layer throughput (Scale L1), optimizing blob transactions (Scale Blobs), and improving user experience. This strategic focus acknowledges that Ethereum's long-term viability depends on solving its fundamental scalability constraints.

Vitalik Buterin Proposes Multidimensional Fee Structure For Ethereum

Ethereum co-founder Vitalik Buterin and developer Anders Elowsson have introduced EIP-7999, a proposal to streamline transaction fees on the network. The new structure would allow users to set a single maximum fee for transactions, replacing the current system of separate fees for gas, data usage, and priority.

The proposal, still under review, aims to lower barriers for new users and improve fee predictability. If implemented, it could help Ethereum maintain its competitive edge by simplifying transactions without compromising security or decentralization.

Ethereum has historically struggled with high and unpredictable fees. Network congestion in 2017 caused significant spikes, while the 2021 NFT boom pushed average transaction costs above $50. The March 2024 Dencun upgrade brought some relief, reducing gas fees for routine transfers.

Ex-SEC Official's Crypto Collapse Warning Sparks Industry Backlash

Former SEC chief of staff Amanda Fischer ignited controversy by comparing liquid staking mechanisms to the risky practices that precipitated Lehman Brothers' 2008 downfall. The crypto industry swiftly rebuked her analogy as fundamentally flawed.

Regulatory clarity took center stage as the SEC clarified most liquid staking activities fall outside securities laws. Fischer's subsequent criticism of this stance drew accusations of either ignorance or deliberate misrepresentation from industry leaders.

Magic Eden's general counsel Joe Doll led the counteroffensive, branding Fischer's statements as technologically illiterate at best or malicious at worst. The debate highlights growing tensions between regulators and an industry demanding nuanced understanding of blockchain innovations.

Ethereum Price Rally Anticipated in Q3 2025 Amid Technical Strength and EIP-7849 Upgrade

Ethereum (ETH) is showing robust signs of an impending uptrend as it enters the third quarter of 2025. Technical indicators, record-high staking activity, and the forthcoming EIP-7849 upgrade—which promises to slash transaction fees by up to 30%—are fueling bullish sentiment.

For investors seeking exposure without direct trading or staking, AIXA Miner offers a streamlined solution. The cloud-based platform leverages AI to dynamically allocate mining resources, delivering daily ETH rewards without requiring technical expertise or hardware. Its focus on Ethereum aligns with the asset's resurgence this year.

Unlike traditional exchanges, AIXA Miner operates as a hands-off mining service, abstracting infrastructure management while capitalizing on ETH's projected growth. The platform's automated approach caters to both retail and institutional participants eyeing passive yield opportunities.

Will ETH Price Hit 4000?

Emma from BTCC highlights that ETH's path to $4,000 depends on overcoming resistance at $3,919.77 (Bollinger Upper Band). Key drivers include:

| Factor | Impact |

|---|---|

| ETF Inflows | High |

| EIP-7849 Upgrade | Medium-Term Bullish |

| MACD Momentum | Short-Term Positive |

If bullish catalysts persist, a Q3 2025 rally above $4,000 is plausible.